The drone industry has grown exponentially over the years, and the advancements in technology have contributed to its significant expansion. According to the latest data, the global drone market as a whole (commercial + recreational) will be worth US$55.8 billion by the year 2030. As the drone industry continues to evolve, investors are looking for opportunities to capitalize on the latest trends, which are covered in the latest Drone Investments Database by Drone Industry Insights.

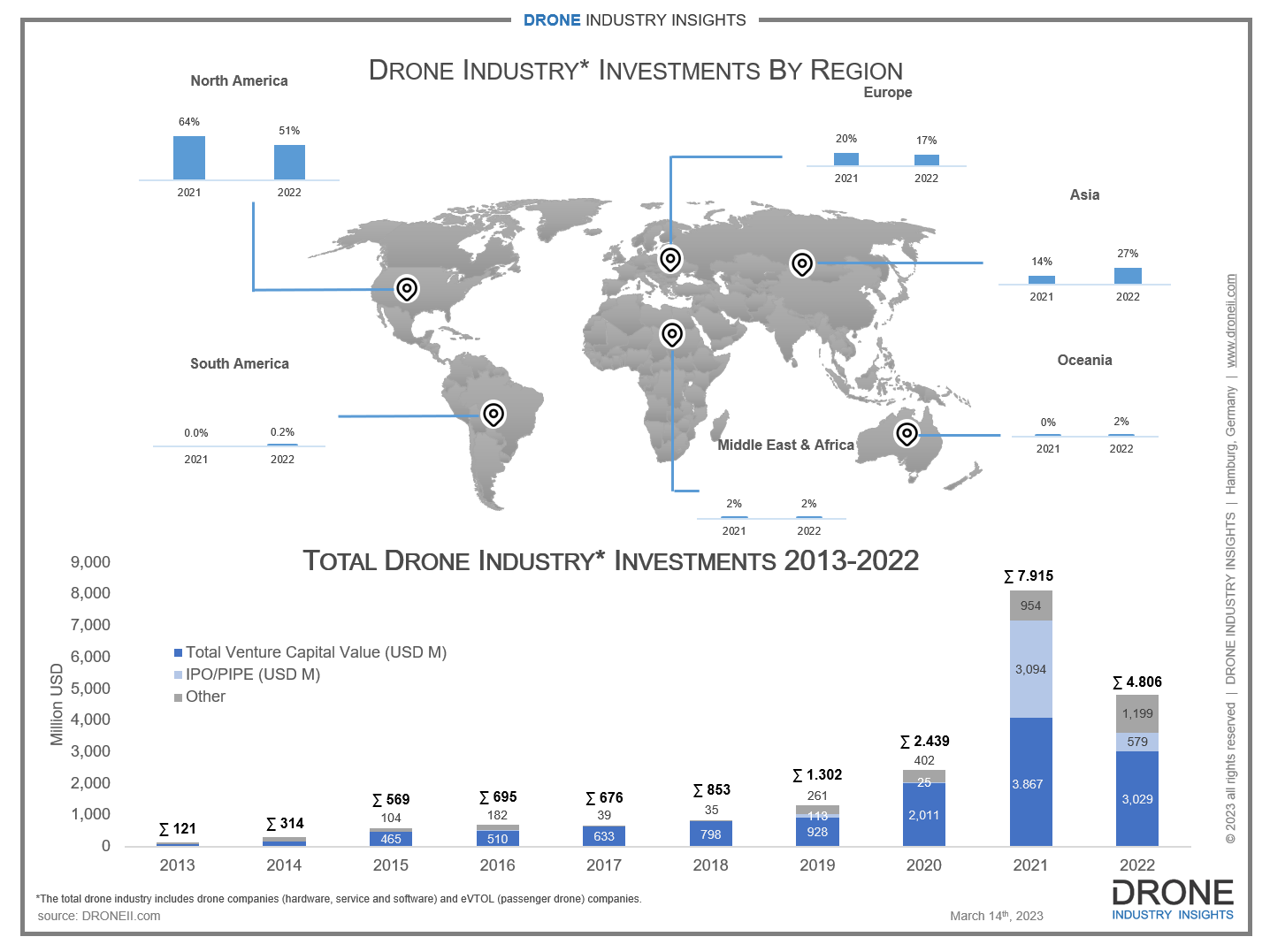

In 2022, investments going into the global drone industry reached over US$4.8 billion. Although this figure is lower than in previous years, it nevertheless highlights the amount of money that is going in towards the advancement of drone technology and the entry of new products and services into the market. The following are the top investment trends in the drone industry:

Hardware, Software and Services

The demand for high-quality drone hardware continues to increase as more industries adopt drone technology. This demand has led to increased investments in drone hardware, with investors seeking to capitalize on the opportunities in the market, which continues to be the most significant driver of growth in the drone industry. Meanwhile, drone software companies grew more than double from receiving US$210 million in 2021 to receiving investments worth US$534 million in 2022. Lastly, drone service companies received the smallest amount of investment in 2022.

Analyzing the specific area of Advanced Air Mobility (AAM) investments, eVTOL hardware companies received the highest investments at US$3.1 billion, surpassing the other two AAM categories - Cargo Hardware (US$52 million) and Delivery Service companies (US$67 million).

Type of Company and Top Regions

Investments in the drone industry have shown a change in the type of deals made in 2022. About 37% of investments were made in the early stages of venture capital, while the "Debt" deal type increased by 24% due to companies receiving more bank credit. However, there was a decrease in the number of IPO/PIPEs compared to the previous year when many eVTOL companies entered the stock market through these deals.

While North America remained the top region for drone industry investments in 2022, it is losing its dominance over the market. The region represented 64% of the total investment value in 2021, but this number dropped significantly to 51% in 2022. Meanwhile, Asia has emerged as a major player in the drone industry, rising from 14% in 2021 to 27% in 2022. This change allowed Asia to surpass Europe, which fell from 20% to 17% in 2022.